Why Refinance? FHA Home Loan Answers

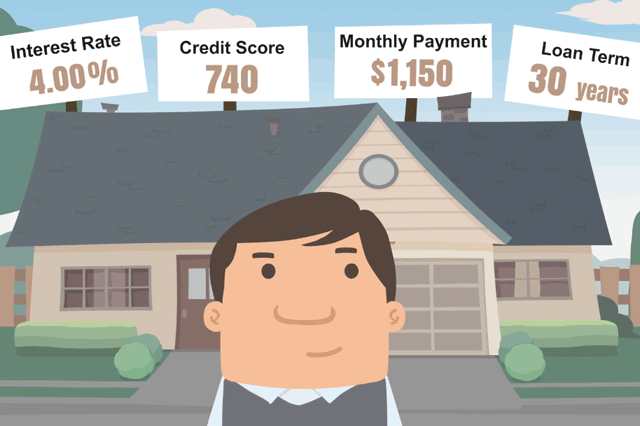

Naturally, favorable-to-the-borrower interest rates are subject to change. By the time you read this you may be wondering if the low rates passed you by. But refinancing isn’t just about mortgage loan interest rates and the reason a borrower may wish to refinance could have as much to do with their short-term and mid-term financial goals as long-term savings via lower mortgage rates.

Why should you consider refinancing into an FHA mortgage? There are several motivations including getting out of an adjustable rate mortgage, refinancing to pull cash out of your property, and refinancing to get the name of a co-borrower off the mortgage.

FHA Refinance Loans for Those With Adjustable Rate Mortgages

Did you purchase real estate with an adjustable rate mortgage? Borrowers who do so often get lower introductory rates for a limited amount of time but once the teaser rate ends and the mortgage rate adjustments begin, some borrowers start looking to refinance to get out of the adjustment cycle.

You can refinance an existing FHA mortgage or a non-FHA mortgage alike; your FHA refi options include cash-out and no cash-out refinancing. Borrowers with existing FHA mortgages have the additional option of applying for an FHA Streamline refinance loan that has no FHA-required credit check or appraisal in most cases.

Lender standards will determine whether a credit check or appraisal may be needed.

FHA Refinance Loans to Take Cash Back

If you want cash back on your refinance loan transaction, apply for an FHA cash-out refinance mortgage.

This kind of loan will require a new appraisal and a credit check, so you will need to prepare for the credit application the same way you did for the initial loan. Refinancing real estate purchased with an FHA home loan is usually possible as long as the borrower is financially qualified AND will use the home refinanced with the FHA mortgage as her primary residence.

FHA cash-out refi loans are not available for properties that are not owner-occupied; you must occupy the home being refinanced as your main address after closing.

FHA Refinance Loans to Remove a Borrower From the Loan

It is possible to refinance a mortgage loan in order to buy out or remove a co-borrower from the loan. State law and lender standards will apply in such cases but know that you do have the option to refinance and move a co-borrower off the mortgage.

It’s best to ask your loan officer about how this should proceed in case state law or lender rules make it necessary to take additional steps.

------------------------------

RELATED VIDEOS:

Home Equity Can Secure Your Second Mortgage

Consider the Advantages of Discount Points

FHA Limits are Calculated and Updated Annually

Do you know what's on your credit report?

Learn what your score means.